|

What will 2021 bring us? After a year of turmoil and surprises, no one has a clear crystal ball. But there are some certainties, and one is that the federal government is changing a variety of number affecting the finances of businesses and individuals. First, any individual or business that received government funds this year should keep that in mind and have records on hand. This includes unemployment benefits and Paycheck Protection Program funds. The taxable situation for these can be complicated, so be sure to discuss them with a financial professional before the end of the year. Meanwhile, here are the big changes for 2021. Affordable Care Act "affordability" percentage Per IRS Revenue Procedure 2020-36, the ACA "affordability" percentage for 2021 is 9.83%, increasing slightly from 9.78% in 2020. This means that, for 2021, employers subject to the ACA cannot charge employees more than 9.83% (of their household income) for the least-expensive self-only health insurance plan. Employers may use one or more of these three IRS safe harbor methods to determine employees' household income:

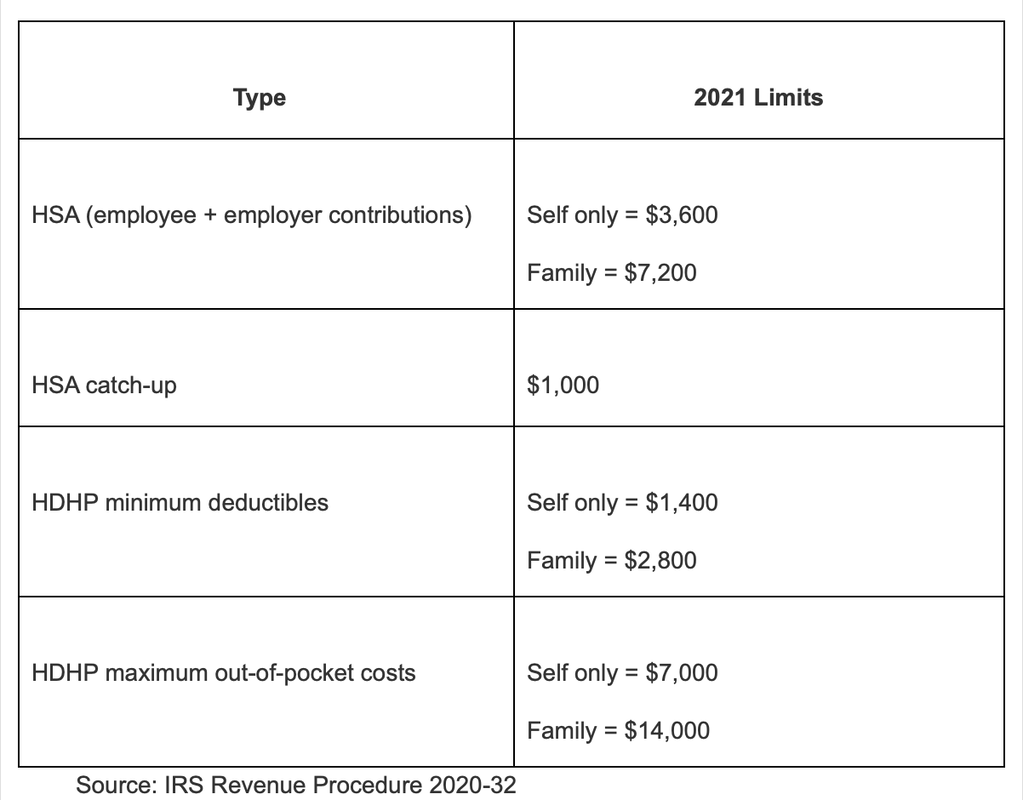

ACA reporting IRS Notice 2020-76 extends the deadline for employers to furnish ACA Form 1095-C or Form 1095-B to employees — it is changing from Jan. 31, 2021, to March 2, 2021. The notice also extends the IRS' good-faith effort relief for plan year 2020 reporting. Under the good-faith effort relief, employers will not be penalized for submitting incomplete or inaccurate ACA forms if they can "show that they made good-faith efforts to comply with the information-reporting requirements." The deadlines for filing Form 1095-C and Form 1095-B with the IRS remain the same: Feb. 28, if filing by paper, and March 31, if filing electronically. Social Security wage base The Social Security Administration announced that the Social Security taxable wage base for 2021 is $142,800, jumping from $137,700 in 2020. The employee's and the employer's Social Security tax rates remain at 6.2%. The Medicare tax rate for 2021 is still 1.45% of all taxable wages, for both the employer and the employee. Employees earning more than $200,000 for the year are still subject to an additional Medicare tax of 0.9%. Health savings accounts and high-deductible health plans Health flexible spending accounts

This limit has not changed; $2,750 remains the limit for health care flexible spending accounts. However, the maximum carryover amount for 2021 has gone up to $550, an increase of $50. Qualified commuter benefits The contribution limit for pretax commuter benefits is $270 — the same as in 2020. This is the maximum pretax amount that employees can set aside to pay for public transportation, ridesharing, vanpooling and parking expenses. 401(k) contributions Here are the 2021 contribution limits for 401(k) plans:

Other inflation adjustments The standard deduction for married couples filing jointly for tax year 2021 rises to $25,100, up $300 from 2020. For single taxpayers and married individuals filing separately, the standard deduction rises to $12,550 for 2021, up $150, and for heads of households, the standard deduction will be $18,800 for tax year 2021, up $150. For tax year 2021, the tax brackets and their limits are as follows:

The bottom line? It's been a complicated year. Touch base with financial professionals before the end of the year to make sure you're on track for any adjustments. Comments are closed.

|

Newsletter articles are posted every 2 weeks. If you would like to have our e-newsletter delivered directly to your inbox, please sign up. Your information is confidential; you can unsubscribe at any time. Subscribe. Categories

All

|

Proudly powered by Weebly

RSS Feed

RSS Feed